Advantages and Disadvantages of Currency Options

Unlike currency forwards where you buy currency for a specific date in the future and are locked into the deal. Myforexeye is one of the leading full foreign currency exchange in all over India.

Currency Options How To Trade In Currency Options With Features

This is an advantage to disciplined traders who know how to use leverage.

. The best rated Forward Contracts And Currency Options Advantages Disadvantages broker IC Markets offers competitive offers for Forex CFDs Spread Betting. The main advantage of this investment approach is to help reduce the risks and losses of the investor. Get a customized FX solution from JP Morgan that lets you book FX trades.

We are dealing in Rateaudit Ratecheck Transaction Process Outsourcing forex risk advisory trade finance. Benefits of Currency Hedging. Ad No Hidden Fees.

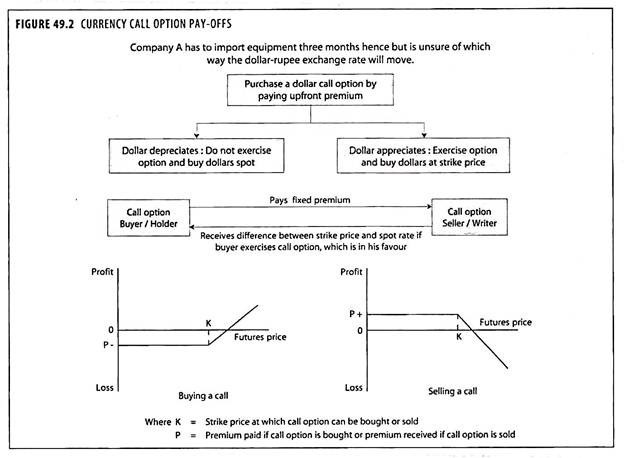

The main difference between the two is that in currency options trading their values are determined at a specific time period. They can only be settled on the date specified in the contract. With extended global trading hours trade nearly 24 hours a day 5 days a week.

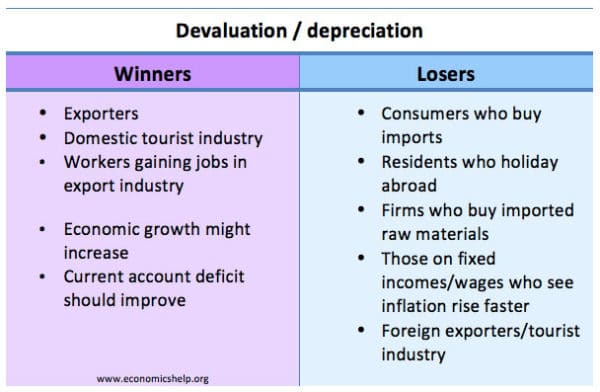

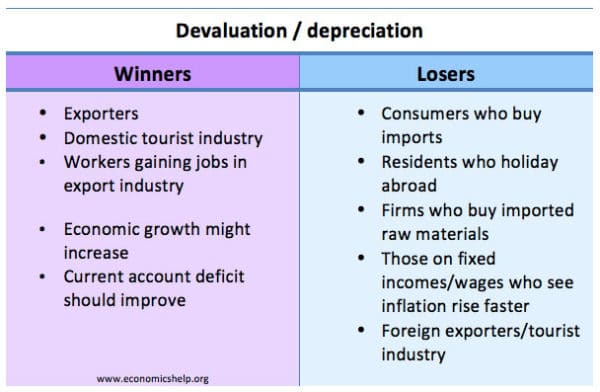

What Is Currency Or Forex Trading Basics Meaning Examples. Forward contracts are private and customized contracts between two parties. Advantages And Disadvantages Of Devaluation.

Ad With over 40 years experience in options trading we have a robust set of tools. Here are the pros and cons of hedging currencies. Currency hedging is a strategy that allows an investor to minimize and control the risks involved in foreign investment particularly one that relates to foreign currency trading.

Advantages of OTC FX options. The best rated Advantages of Currency Options broker IC Markets offers competitive offers for Forex CFDs Spread Betting Share dealing Cryptocurrencies. Evaluate and execute sophisticated trading strategies with IBKR.

Explain the conditions regarding your expectations of the. The most common advantages include easy pricing high liquidity and risk hedging. Options allow you to employ considerable leverage.

What are some advantages and disadvantages of currency options as compared to forward contracts when hedging payables. There are many advantages and disadvantages of future contracts. Ad An easy and capital efficient way to gain exposure to the broad US.

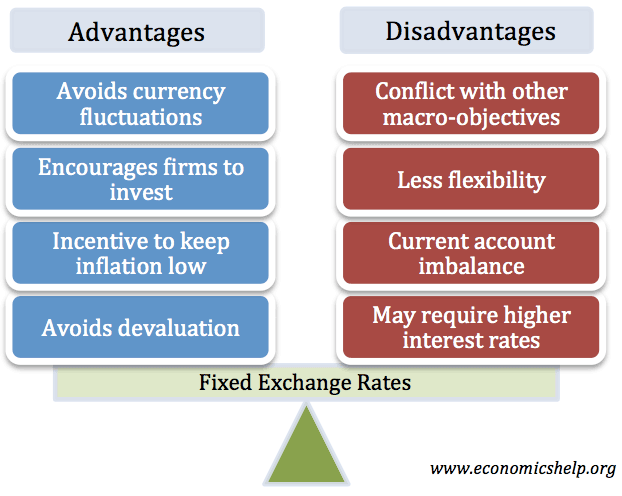

Advantages Of Fixed Exchange Rates Economics Help. The main advantage of buying put options is they give investors the chance to speculate on securities that they feel may be headed for a fall in price. Open an Account Today.

With OTC FX options you pay a. The Advantages of Currency Options. Against the background of problems in the global economy people do not trust fiat currencies and are looking for new options for storing and accumulating capital.

Futures on the other hand are. By using derivative contracts one can replicate the payoff of the assets. For example imagine an.

It is considered that derivatives increase the efficiency of financial markets. Forex or foreign currency. There are many advantages of currency options trading.

Ad JP Morgans cross currency solution allows for more control on your global payments. This is a substantial advantage of futures over options. The more volatile the underlying or the broad market the higher the premium paid by the option buyer.

Currency trading is a specialized skill and requires familiarity with the economies of the countries whose currencies you will trade as.

What Is Currency Or Forex Trading Basics Meaning Examples

Advantages Of Fixed Exchange Rates Economics Help

Advantages And Disadvantages Of Devaluation Economics Help

Currency Options And Its Benefits Derivatives Forex Management

Free Currency Tips Stock And Nifty Options Tips Commodity Tips Intraday Tips Rupeedesk Shares Day Tradin Day Trading Stock Trading Strategies Trading Charts

Comments

Post a Comment